How The Most Successful Private Equity Dealmakers Get Conviction In A Deal

Tap Into Your Limbic Brain For Conviction And Efficiency

Do you sometimes have deal paralysis? Are you killing deals which would have been fine in hindsight? Do you suffer not knowing when to tune into your intuition versus relying on the numbers? Are you playing it safe?

Here’s how the Chairman of General Atlantic’s Investment Committee describes his investment decision process:

Step 1: “Ground yourself in facts with a checklist to make sure you gather all the relevant information.”

[Rational brain]Step 2: “I look at the checklist, and then I close my eyes and listen to my intuition / see how I feel.”

[Limbic brain]“Educated Intuition” is the best way to make investment decisions.

Source: thetwentyminutevc.com/martin-escobari/ (Minute 26)

What is Step 2 all about?

To an analytical person, it might sound a bit crazy to “close your eyes and see how it feels.” But what’s the magic of how one of the world’s best private equity investors makes investment decisions?

I. Rational analysis is a building block of good decisions, but doesn’t create conviction.

As a private equity professional, you’ve always demonstrated analytical excellence. And an internal fear of missing something has kept you on your toes: sanity checking the math just one more time.

Many PE professionals rely on the analytic approach of scrubbing historical trends to extrapolate theories about the future. Projections are an educated guess, so reality often differs from the modeled case. While the output of rigorous analysis can give one a sense of certainty/control, the fight-or-flight brain pierces this illusion under moments of stress.

As a result, analytical professionals often lose conviction in front of IC in key moments, sputtering and losing their train of thought. The dance of the Rational brain — iteratively antagonized by the fearful Reptilian brain — does not produce consistent conviction.

II. The most successful dealmakers rely on their Limbic “feeling” brain.

You know the PE Partner who hears a little bit about a deal, maybe asks one question, and immediately has an ‘intuition’ that a deal is probably a go or a pass?

This Partner can often tell you what the business unit economics, projections and LBO returns look like without ever seeing the CIM. It can look arbitrary to a third party, or even frustrate those who so strongly cling to their analytic belt and suspenders process.

So how do you get conviction in an investment decision when logical analysis only gets you so far, and your fight-or-flight brain is chirping in the background: warning you of negative potential outcomes and urging you to kill the deal?

III. Great companies have a CEO, Board of Directors, and Shareholders. So do you.

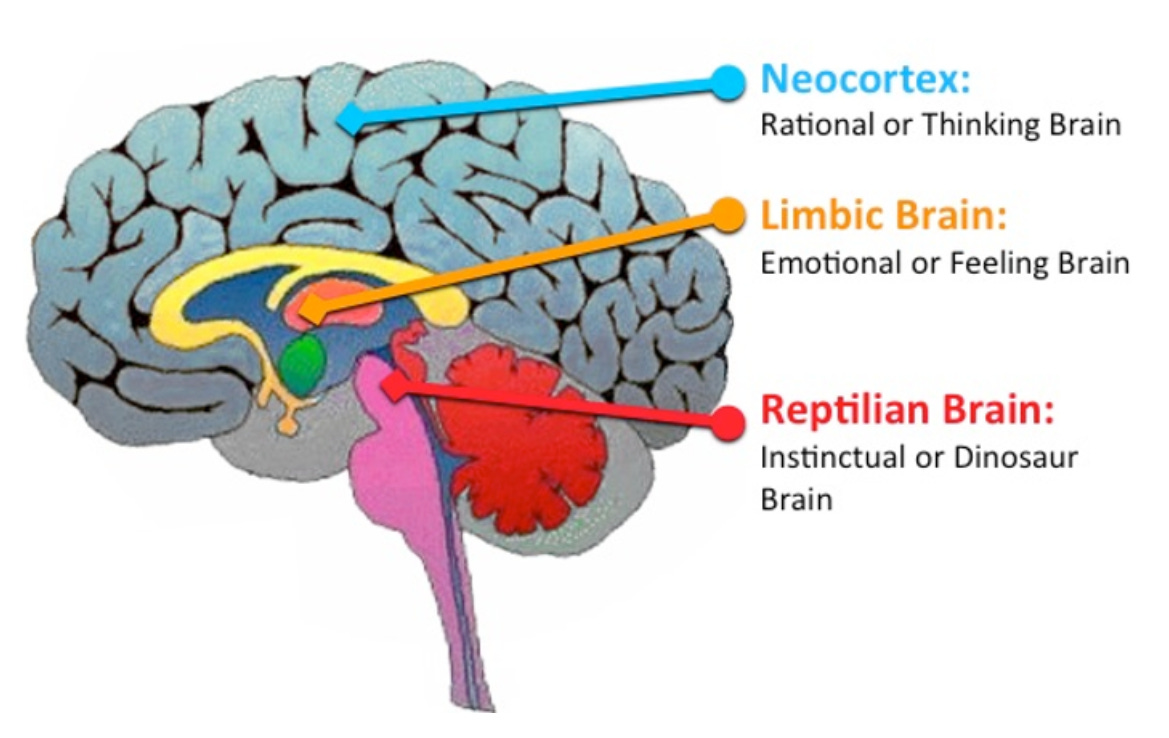

Three parts of your brain triangulate to create conviction in an investment decision.

a) Reptilian Brain = Shareholders

Evolutionarily, the oldest part of your brain is the Reptilian Brain. It operates like a radar: constantly scanning for Threats. When a potential Threat is detected, a shot of Anxiety jolts you into action and enacts a Defense against the perceived Threat.

Like a metal detector: sometimes the Reptilian brain detects harmful threats and helps you survive; other times, the beeping is just noise and a distraction — yet both trigger the alarm equally. The fight-or-flight brain directs its attention to the stock price ticking up and down. It “sounds the alarm," making you aware of the wins, losses, problems and failures. It speaks in black and white terms, and tends to project into the future and imagine catastrophic consequences if you don’t act now! Like a gray-haired activist investor, it can be self-righteous and extremely convincing in the moment. It frequently demands that you do something to change the perilous status quo.

While helpful to your survival, the Reptilian brain lacks the perspectives of the Limbic and Neocortical parts of the brain.

b) Limbic Brain = CEO

Mammals have a Limbic brain, which is wrapped around the core Reptilian brain. The Limbic brain gives mammals a desire to connect with others. It allows mammals to sense each others’ moods.

The Feeling brain is like a supercomputer, drawing on a lifetime of reps. Through pattern recognition, this Intuitive brain senses / sniffs the set up of any deal.

Without much justification, the Limbic brain tells you where to dig a little, then immediately senses whether something is likely a go / no go. This is the part of you that feels your way.

Rational analytics can only bring you so far, and Reptilian fear can paralyze you / find reasons to kill the deal. The ‘spidey sense’ of the Limbic brain allows you to pull the trigger and decide to do a deal.

c) Neocortical Brain = Board Of Directors

The newest part of the brain is the “Neo”-cortex. It is very large in humans and gives us the ability to speak and reason. This rational third party gathers data, considers the facts in aggregate, and deduces the best outcome based on the limited information it has.

This Analytic brain attempts to make investment decisions by deep diving incomplete information. Often analytical technicians freeze when it comes to making the investment decision. Their analysis paralysis often “proves” that the future is uncertain.

Rational analytics are inherently limited:

1. Projections are made up!

2. Multiples are circular triangulations based on made up exit multiples, perpetuity growth rates and discount rates.

3. No one has a crystal ball and can predict the future.Those who rely too much on analysis can start to believe they can predict the future — their prediction is often quickly disproved, sending the individual back to being terrorized by their Reptilian brain.

IV. How to empower your Limbic brain.

You can make better investment decisions with greater efficiency by empowering your CEO and tuning into your Limbic brain.

Why would you blindly follow the analysis of your Board, or react to the demands of an impatient Shareholder?

Channeling the power of your CEO / Feeling brain looks like:

Bring awareness to how you feel as you hear about a new investment opportunity.

Before letting the rational brain start judging, listen to your body. Follow a breath into your body and pay attention to what you're sensing. Write down what you’re sensing, without letting the rational brain pick it apart.

As you listen to your body, differentiate between gut reactions driven by the fearful Reptilian brain, versus intuitive sensations from the Limbic brain.

The Limbic Brain references an infinite library of data stored deep in your mind, and spits out highly informed insights, which your rational brain often cannot comprehend.

NB: an analyst with two years of experience ought to stick to rational excellence in analysis. They don't have enough reps yet to have an informed intuition.

The closest thing we can get to conviction comes from tuning into our Limbic intuition. Let the analytics be a sanity check. All that work takes a lot of time anyway.

Additional Reading

20VC: with Martín Escobari, Co-President @ General Atlantic: In addition to describing his deal decision process, Martín is asked “How do you keep a youthful mind?" Martín explains: One of the beauties of the investment profession is that you accumulate experience and pattern recognition, and provided your mind doesn’t get old, you get better. Young minds are playful. Young minds Wander. Make silly mistakes and laugh at themselves. Old minds are preachers of the truth; moralists. You have to remain playful and humble. If you can combine the wisdom and experience and pattern recognition with the playfulness/wander and avoid the preaching, you stay relevant longer, and you can have a positive impact.

A General Theory of Love: A deep dive into the Triune Brain: the interplay of the Reptilian, Limbic and Neocortical brains.

Start With Why, by Simon Sinek. People make intuitive decisions in the Limbic part of their brain, and then they use their Neocortical brain to back into a bunch of reasons why their initial feeling is valid. Apple lights up our Limbic brain by leading with their Why: “Everything we do we believe in challenging the status quo; we believe in Thinking Differently. The way we challenge the status quo is by making our products beautifully designed, simple to use, and user friendly. We just happen to make great computers. Wanna buy one?”

Related Private Equity Insights With JD Pieces

Are Your Instincts Helping Or Hurting: Managing Your Instincts For Success As A Private Equity Partner

“Gut Instinct” And “Intuition” Are Often Confused: How to channel the infinite power of your Intuition and stop reacting to your survival instincts

Perfectionism In Private Equity Is Useful Until It Hobbles You

This is a twice a month newsletter exploring breakthrough insights from 5000+ hours of 1x1 executive coaching with your best and brightest Private Equity and Growth Equity peers, subscribe here: